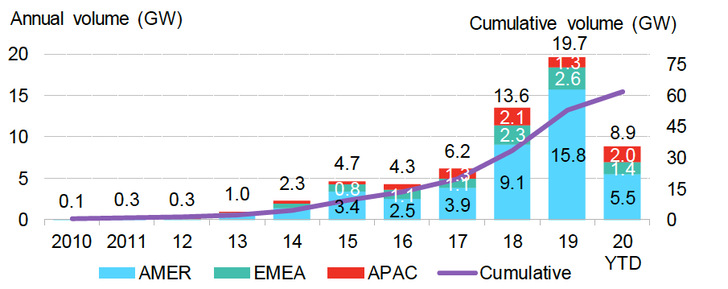

Private enterprises and public institutions bought 8.9GW of clean energy through power purchase agreements in 2020 through July. Though activity is currently pacing ahead of 2019, a big second half will be required in order for the market to hit record volumes by year-end, with Covid-19 the biggest adversary that could stall growth. More than in previous years, deals will have to be globally spread for a new record to be established in 2020, as the U.S. – the world’s largest corporate PPA market – has seen activity drop significantly, partially due to the pandemic. Other regions have picked up the slack: Latin America is positioned for a record year, off the back of bespoke agreements signed by firms in Brazil’s wholesale market. Procurement in Europe is rapidly diversifying away from the Nordics and into new markets like France and Spain. In Asia-Pacific, Taiwan and Australia have seen significant activity and South Korea is poised to be the next great corporate procurement market.

The shortfall in RE100 clean electricity demand is now projected to reach 224TWh in 2030, up from our previous estimate of 210TWh. Some 21 new companies have joined the RE100 year-to-date, bringing total signatories to 242 and electricity demand to 247TWh. The campaign is growing faster than developers can supply it, with 18TWh of incremental electricity demand added this year, far exceeding (when put in capacity terms) the 1.1GW of clean energy purchased by incumbent members over the same period. This bodes well for the long-term health of the corporate procurement sector.

Negative effect on power procurement activity

Covid-19’s impact on corporate procurement varies significantly around the world. Some markets have seen only modest impact from the pandemic, limited to slower development of some clean energy projects, and budget and priority reshuffling on the part of some corporate buyers. South Korea could even provide a boost, with its stimulus package including a specific carve-out to create a mechanism of power purchase agreements (PPAs). For markets like China, India, the U.S. and particularly Mexico, on the other hand, the pandemic is having a negative effect on power procurement activity.

Corporate PPA activity in the U.S. slumped to just 4.3GW year-to-date. Historically scorching hot U.S. corporate market Texas (ERCOT), which saw 5.5GW of PPAs in 2019, dropped to just 940MW of deals through July. The pandemic has caused power demand in ERCOT to drop as much as 9% on some days, depressing power prices and weakening returns on existing PPAs, while hurting the outlook for future deals. The pandemic may boost subsidy programs for commercial solar in some states, however.

Spain hottest procurement market in Europe

Companies in Latin America continue their migration to the wholesale market. The region is pacing for a record year in corporate procurement activity, due to firms in Argentina, Brazil and Chile choosing to purchase clean energy through their country’s wholesale market. Brazil alone saw 860MW of deals announced through bespoke contracts in its free market. This surge in activity was enough to offset the dismantling of Mexico’s clean energy market by the country’s current administration, in the name of bolstering grid reliability.

Europe is no longer a one-trick pony, with PPAs totaling 1.4GW signed in nine different markets in 2020 through July. The Nordics, which typically dominate, saw just 400MW of PPAs announced in the first seven months. A warm, wet winter led power prices in the region to their weakest start in over a decade, curbing appetite from buyers. Spain has emerged as the hottest procurement market in Europe, with the cheapest solar PPAs and the most competitive wind prices after the Nordics. Companies are signing pan-European PPAs in Spain, capitalizing on cheap prices to offset their consumption across the rest of the region.

Market liberalization in Taiwan

Australia is back on the radar, with PPA activity already up 50% over 2019 as a whole. Multi-nationals like Amazon and Aldi Foods have announced contracts in 2020, attracted to the flexibility of Australia’s corporate procurement market, which mirrors the U.S. in many ways. Outside of PPAs, companies can use sleeved contracts, purchase certificates or work through re-insurance providers using products like proxy revenue swaps. Only the country’s rooftop solar market is moving in the wrong direction, with installations poised to fall short of the 750MW in 2019 even under the best scenario, largely due to the pandemic.

See also this article:

Green hydrogen for under 1 USD/kg by 2050

Market liberalization in Taiwan more than makes up for an underwhelming renewable portfolio standard (RPS) announcement in Mainland China. State utility Taiwan Power was granted a clean power license in April, paving the way for a 920MW offshore wind deal signed by Taiwan Semiconductor Manufacturing Company (TSMC), the largest ever. This will break the ice for other major Taiwanese manufacturers to buy clean energy. It comes as China set inaugural RPS targets of 10.8% – largely uninspiring goals that won’t drive significant corporate clean energy demand.

Government-run pilot program

South Korea is Asia’s newest corporate procurement sweetheart. A government-run pilot program has created certification schemes for mechanisms like PPAs, direct investment, sleeved contracts and onsite generation. A Covid stimulus package is also expected to create legislation for a direct PPA product. Both the pilot and the stimulus will greatly benefit Korea’s largest companies, which are facing supply chain pressure to decarbonize.

Southeast Asia looks like an up-and-coming corporate procurement market. Malaysia just finished piloting a peer-to-peer energy trading program, Singapore has a growing number of retail clean energy supply products and Vietnam is on the verge of piloting a direct PPA mechanism. The region is brimming with potential and has an abundance of large energy consumers – perfect for a flurry of future activity. (mfo)