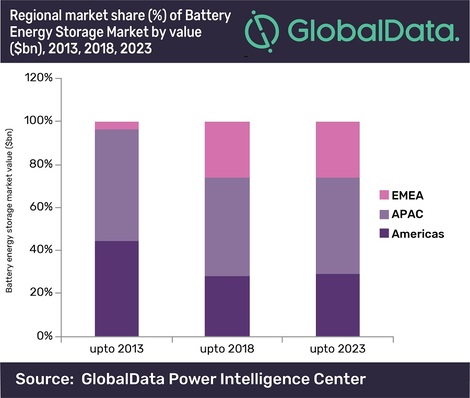

Throughout this period of strong growth the Asia Pacific region, led by China will dominate installations with 273 GWh out of 635 GWh, or some 43% of all energy storage capacity while the rest of Asia adds around 155 MWh or 24.5%. Europe will install some 20% of total cumulative capacity, and the US just 67.7 or some 10.7% of total global capacity. MEA and Latin America will effectively be left behind with a few percentage points each.

Key technology lithium ion batteries

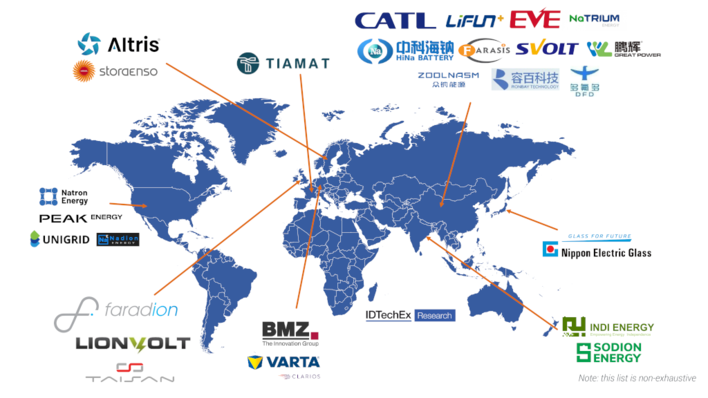

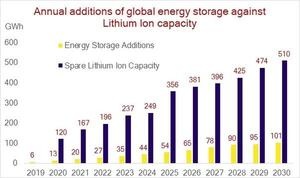

The key technology will be lithium ion batteries which have massive momentum, brought about by the arrival of electric vehicles. The top 10 manufacturers alone have planned some 510 GWh of annual global factory capacity by 2030, with 45% of global lithium ion manufacturing capacity located China and Europe and South Korea also acting as strongholds, mostly through partnerships with Chinese players.

There will be plenty of room for alternative energy storage technologies such as vanadium flow and large storage GWh-class devices including ETES, Liquid air and Energy Vault cranes based systems, but without the huge investment in lithium ion batteries, this segment would not take off quite so rapidly. We estimate that 90% off the global energy storage market will remain lithium based until a new technology emerges to lead, possibly by 2040.

Decisive role of the combination of storage and solar

What Rethink has not done is call all the largest developers, ask for their pipeline activity and added it up, neither have we simply assumed the US will dominate. Instead a set ratio between solar and energy storage was assumed, and wind and energy storage and calculated its likely changing attach rate. Eventually the US, China, Western Europe and advanced Asian nations, will have an attach rate of 50% of all new solar installations by 2030, i.e. 50% plus will have storage installed with solar.

The energy storage marketplace will rapidly mature from one focused on grid stability services and energy arbitrage to one which competes initially with peaker capacity, and then wholesale day ahead markets, in partnership with both solar, and to a lesser extent wind. The market will re-accelerate when each reaches parity of solar plus battery versus gas turbines, which in most markets is a few short years.

Weaker U.S. market

While most forecasters are seeing the US as the intellectual property leader this report sees a weaker US market for some time, unless the US tax incentives for solar and battery are extended for a second time, which relies on politics. However the US has 22.6 GWh of hydro pumped storage and developers are well aware of how storage can work, they just need stimulus from politicians. (HCN)