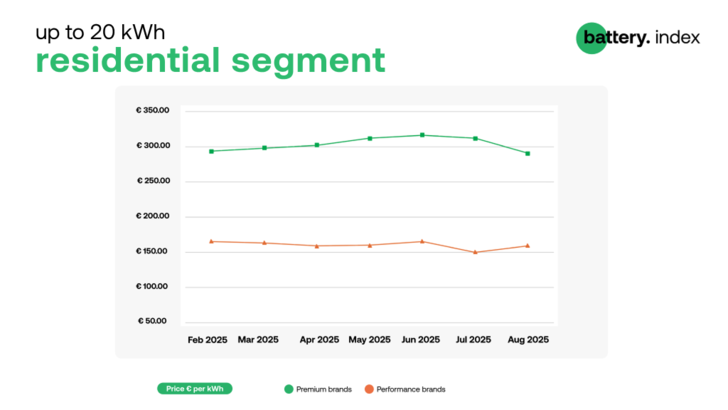

The most notable development in August was in the residential segment. Premium battery brands saw average prices fall by seven percent, from €311.54/kWh in July to €290.34/kWh in August. This marked the first significant decline of the year, reflecting easing supply conditions and greater competition among premium vendors.

Stay informed – subscribe to our free newsletters

In contrast, performance-oriented brands moved in the opposite direction. Their average price increased by six percent in August, from €150.35/kWh to €159.55/kWh. This rebound followed months of decline earlier in 2025, reflecting renewed demand for cost-efficient storage systems as installers seek affordable solutions for residential customers. The spread between premium and performance segments narrowed, though the gap remains close to 100 percent, underlining the structural divide in the battery market.

Battery Index to track price trends and brand dynamics

“The drop in premium battery prices is a welcome sign for installers who were struggling with affordability. Meanwhile, the rebound in performance brands is most probably driven by shortages of some of the most popular brands. Whether the narrowing gap between premium and performance solutions is a sign of things to come, reflecting users’ growing reluctance to pay a high premium for premium products or just a temporary shift remains to be seen,” commented Grzegorz Furman, International Senior PV Trader.

Top 5 brands in August 2025

Huawei consolidated its leadership, taking the top spot for the third consecutive month. In August, Deye overtook Dyness to claim second place, marking a shift in installer preferences. Sungrow and Pylontech also exchanged positions, with Sungrow moving into fourth and Pylontech rounding out the top five.

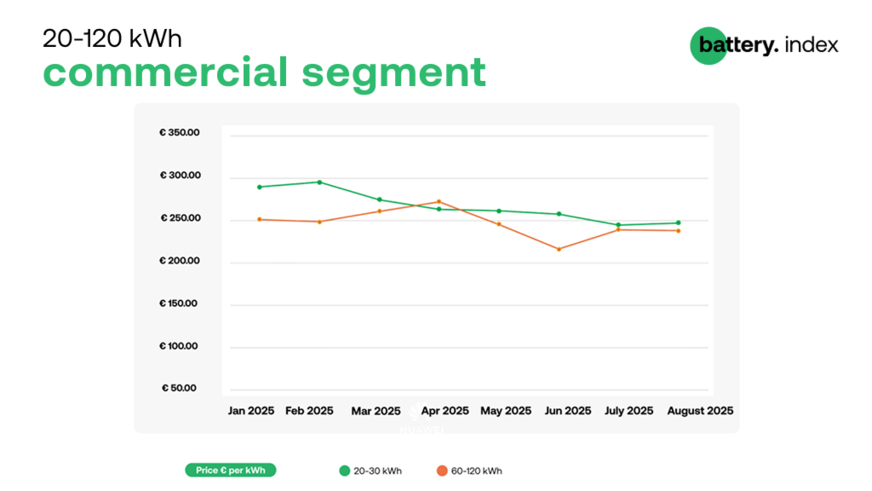

Commercial segment; stability dominates

Unlike the residential market, commercial storage prices remained stable in August. Systems in the 20–30 kWh range inched up from €245/kWh in July to €247/kWh in August, while 60–120 kWh systems edged down slightly from €239/kWh to €238/kWh.

sun.store

This stability indicates that commercial buyers are working on longer project cycles, where price shifts are less abrupt. The variety within the 20–30 kWh range highlights the segment’s role as a testing ground for installers and distributors seeking flexible, mid-sized solutions. By contrast, the 60–120 kWh category remains more consolidated, with Deye, KSTAR and Solax dominating merchant listings.

About

The Battery Index is a monthly report tracking energy storage pricing and brand dynamics across Europe from sun.store. Based on transactional data from Europe’s largest PV and storage marketplace, it provides installers, distributors and EPCs with benchmarks and insight into evolving market trends. (hcn)

More on solar storage.