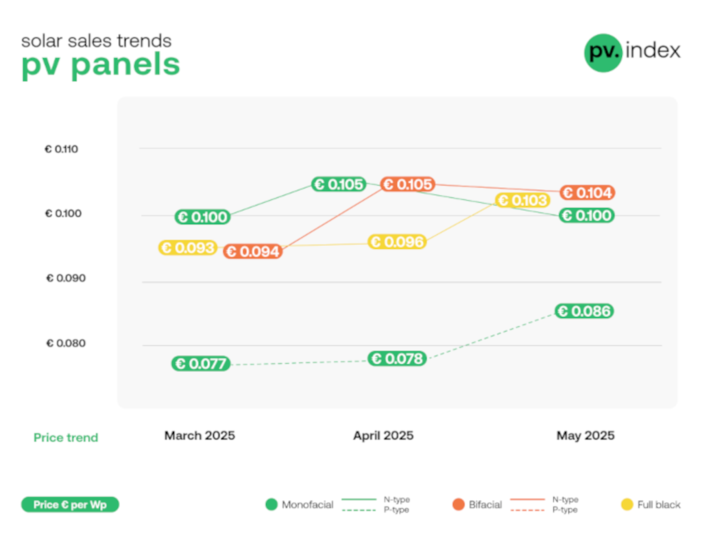

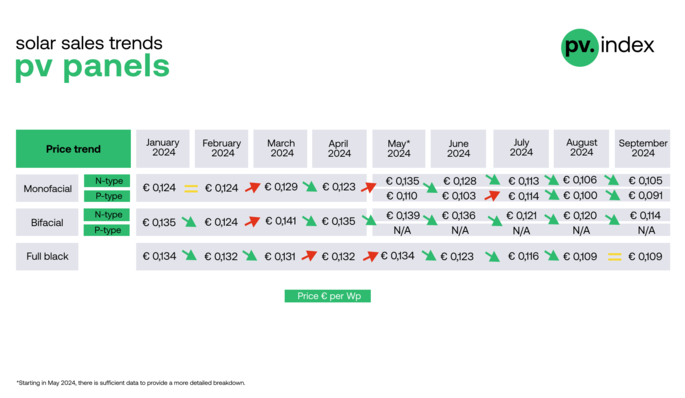

In May 2025, shifting market dynamics saw solar module prices continue to rise, with supply constraints and firm demand putting upward pressure on pricing. In contrast, inverters trended lower, highlighting diverging developments across the PV value chain.

Monofacial P-type modules saw the sharpest increase, up by 10% to €0.086/Wp, largely due to limited availability and mounting pressure on distributors to meet residential and commercial installation timelines.

Full Black modules also experienced a notable 7% price rise, driven by both aesthetic preference and seasonal demand in the residential segment.

Meanwhile, monofacial N-type and bifacial N-type modules remained relatively stable, reflecting balanced supply-demand dynamics in higher-efficiency segments.

Inverter prices

In contrast, inverter prices continued their downward slide, offering welcome relief to installers.

Hybrid inverters dropped by 2% across both the <15kW and >15kW categories, reflecting sustained competition and available stock.

On-grid inverters also saw a marginal 1% decline for small systems (1–15kW), while prices for larger systems (>15kW) held steady.

sun.store

These trends highlight diverging pressures in the solar supply chain – modules are tightening in supply and climbing in cost, while inverters remain available, fuelling a buyer-friendly market. “The recent price increases reflect dwindling stock across the EU. Distributors with limited but in-demand inventory are gaining pricing power, while larger stockholders are reducing prices. Full Black modules, in particular, saw spikes driven by the residential segment and the seasonal surge in installations,” Filip Kierzkowski, Head of Partnerships and Trading at sun.store, commented.

sun.store

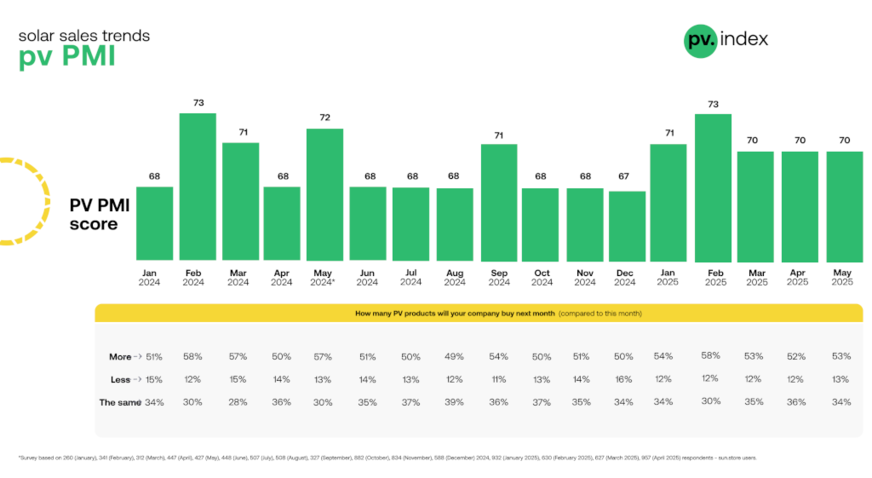

The Purchasing Managers' Index (PMI) remained steady at 70 in May 2025, reflecting balanced optimism in Europe’s solar market as the installation season peaks. Among the 908 sun.store users surveyed, 53% plan to increase purchases, 34% will maintain current levels and 13% expect to reduce orders, indicating resilient demand despite supply challenges.

This stability is supported by the EU’s 2030 renewable energy goals and a projected ~10% growth in PV installations, though grid delays and rising module prices – due to reduced Chinese export rebates – temper enthusiasm. The growing adoption of N-type panels and residential solar boosts confidence, yet seasonal slowdowns and high interest rates suggest a pragmatic approach among buyers.

Expert analysis: the solar market in motion

Outlook for the coming months

With a PMI of 70 and tightening module supplies, the European solar market stands at a pivotal moment. Rising prices for P-type and Full Black modules, driven by diminishing inventories, suggest supply constraints will linger into Q3, especially as global demand intensifies. Inverters, on the other hand, continue to favor buyers, with declining prices for hybrid and on-grid models offering cost-saving opportunities.

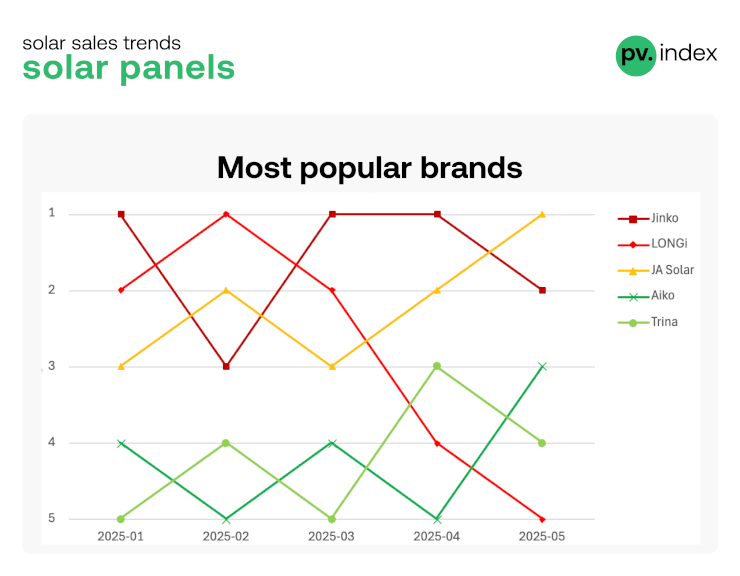

Top brand trends

Solar panels: JA Solar takes the lead Sun.store data reveals a dynamic shift in module preferences. JA Solar has claimed the top spot in May 2025, overtaking competitors with its strong market presence. The top five for solar panels are:

● JA Solar (1st)

● Jinko (2nd)

● Aiko (3rd)

● Trina (4th)

● LONGi (5th)

sun.store

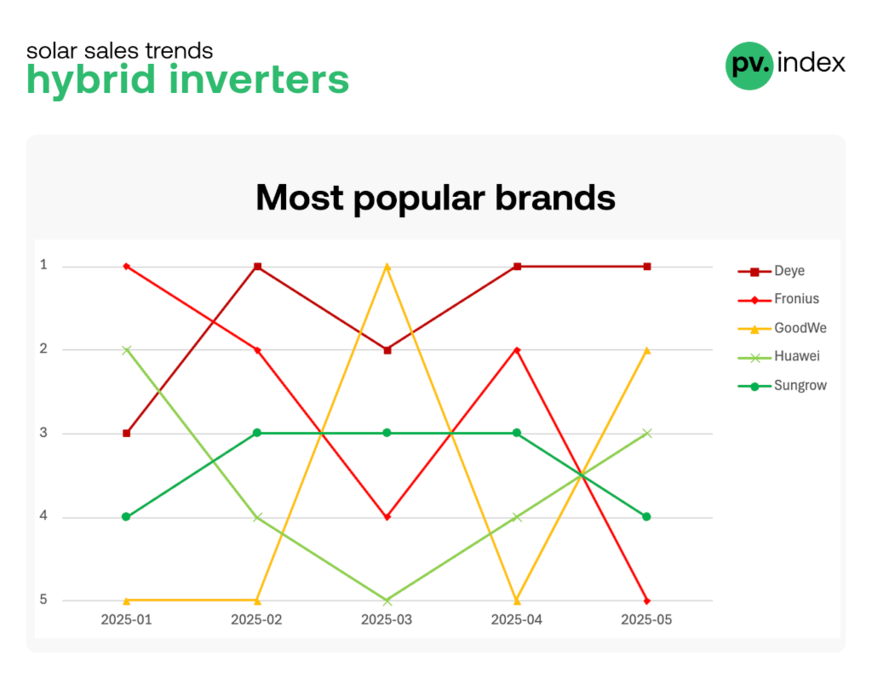

Hybrid inverters: Deye leads with momentum In the hybrid inverter category,

● Deye (1st)

● GoodWe (2nd)

● Huawei (3rd)

● Sungrow (4th)

● Fronius (5th)

sun.store

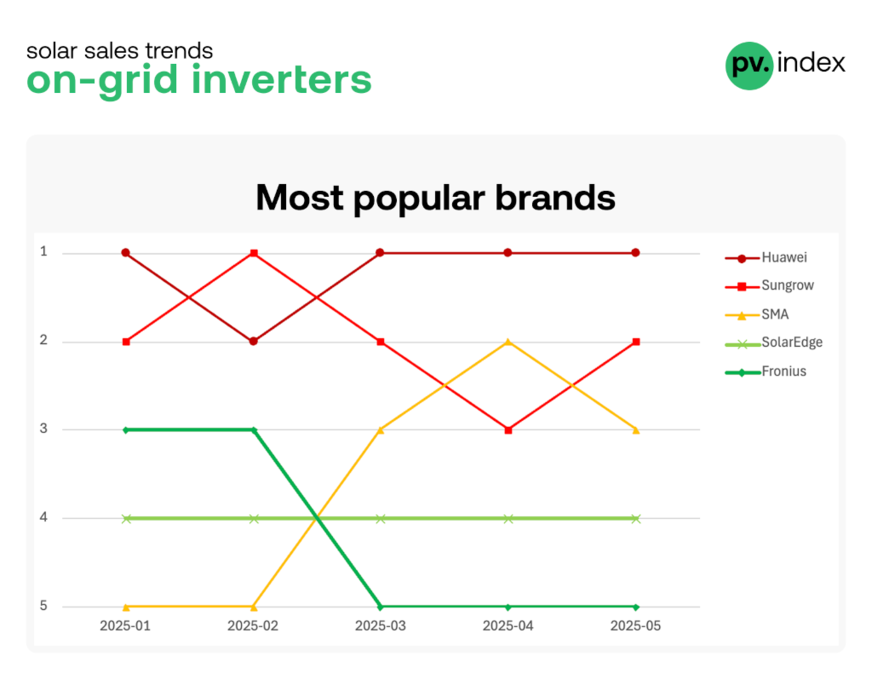

On-grid inverters: Huawei continues to dominate the on-grid inverter market in May, with Sungrow closing in:

● Huawei (1st)

● Sungrow (2nd)

● SMA (3rd)

● SolarEdge (4th)

● Fronius (5th)

sun.store

Methodology

pv.index tracks monthly trading prices for solar components, based on data from sun.store, Europe’s largest online PV trading platform with over 8.9 GW of components available. Prices are weighted by transaction power to provide a reliable market estimate.The PV PMI gauges demand sentiment in the PV industry, with scores above 50 indicating expansion. It’s calculated from a sample of 900+ sun.store buyers, offering a snapshot of purchasing intentions across Europe.

Stay informed – subscribe to our free newsletters

The PV PMI was calculated as: PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0), where: P1 = percentage of answers reporting an improvement, P2 = percentage of answers reporting no change, P3 = percentage of answers reporting a deterioration. Survey is based on a sample of 950+ sun.store buyers. The Top 5 brand rankings below are based on sales value data from the sun.store platform, collected between January and May 2025. (hcn)