As stock shortages increase, partly due to China’s shift towards domestic installations under new pricing policies, platforms like sun.store become essential for sourcing premium modules and quality alternatives from smaller brands at competitive prices. However, these opportunities are quickly diminishing.

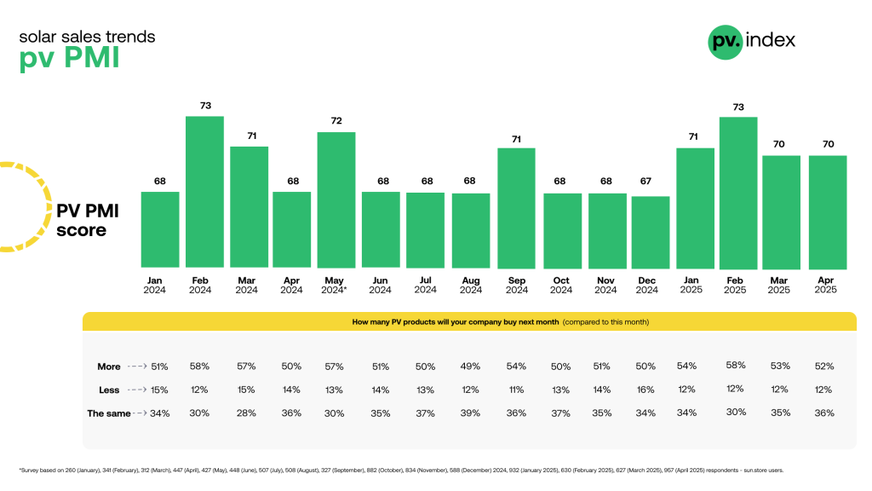

The PV Purchasing Managers’ Index (PMI) remains a crucial instrument for gauging market sentiment and tracking demand trends in Europe’s solar industry. Built on the purchasing intentions of over 950 respondents, selected from a pool of more than 27,000 sun.store registered users, this index delivers a sharp snapshot of the sector’s current dynamics and future trajectory. By capturing insights from a diverse array of installers, distributors, and other key players, the PV PMI illuminates shifting buying patterns, providing essential insights into the major trends shaping the region’s solar landscape.

April’s PV PMI remained at 70, consistent with March, indicating steady sentiment among buyers navigating a constrained market. Based on responses from 957 users out of over 27,000 registered on the sun.store platform, the survey revealed:

● 52% plan to increase purchases, showing efforts to secure stock.

● 36% intend to maintain current order volumes, reinforcing a stable market base.

● 12% anticipate a reduction, a consistent minority reflecting selective caution.

sun.store

Key Drivers

● Supply bottlenecks: Limited availability of popular module brands, intensified by China’s pivot to domestic demand under new pricing reforms, is pushing buyers to act swiftly.

● Premium brand preference: Sustained demand for top-tier brands like JA Solar, Jinko, Trina, and Canadian Solar is pushing average module prices upward, though buyers are increasingly open to quality alternatives from lesser-known brands.

● Seasonal momentum: With spring installations accelerating, sentiment remains steady.

Expert commentary: The market feeling the squeeze

Filip Kierzkowski, Head of Partnerships and Trading at sun.store, commented: “The April data mirrors the current market reality. We’re seeing a clear trend of limited availability for the most sought-after module brands. Producers and distributors holding these products are capitalising on the situation, which is pushing prices higher. Meanwhile, inverter stocks remain plentiful, keeping prices soft – a stark contrast to the module market’s supply crunch. We’re also noticing buyers increasingly pre-booking stock on platforms like sun.store to secure supply, a smart move as shortages deepen.Tightening stocks led to price upticks in key segments.”

New report: Worldwide PV installations could reach 655 GW in 2025

Krzysztof Rejek, VP of Sales at sun.store added:“Demand for premium brands like JA Solar and Jinko remains strong, but dwindling availability of top-tier products is opening doors for high-quality alternatives from less prominent brands at attractive prices. Combined with China’s pivot to domestic installations, this is squeezing module supply in Europe. Inverters, however, are still widely available, offering buyers some flexibility. Those eyeing deals on full black or older stock should move quickly on sun.store before these options vanish.”

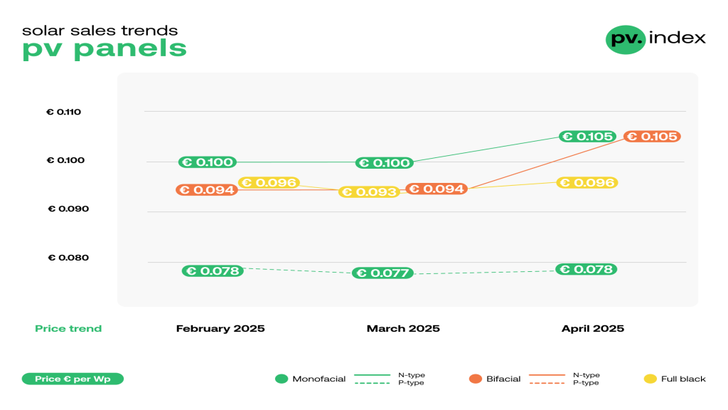

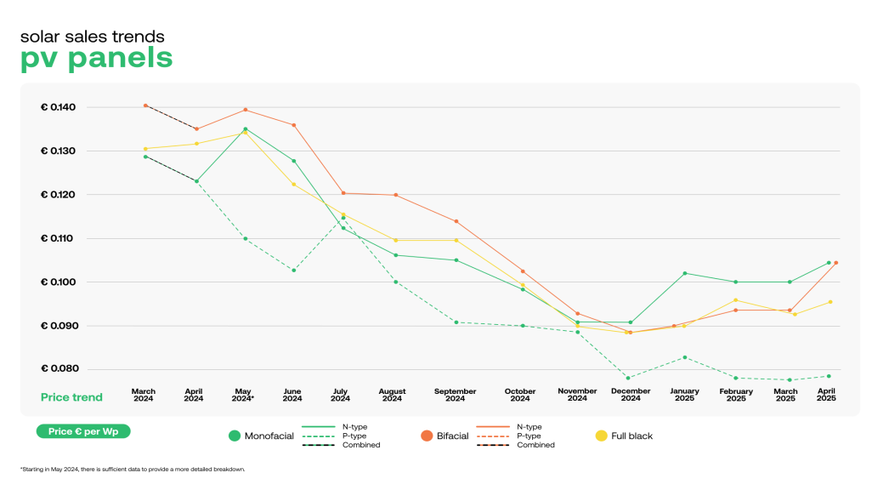

Module prices: Premium brands drive increases

Tightening stocks led to price upticks in key segments:

Monofacial modules:

N-type: Prices rose to €0.105/Wp, a 5% increase, fueled by strong demand for top-tier brands like JA Solar (+5% to €0.105/Wp), Jinko (+4% to €0.101/Wp), Trina (+2% to €0.111/Wp), and Canadian Solar (+6% to €0.107/Wp). The average price for these brands (€0.106/Wp) marks a jump from March’s more affordable leaders, TW Solar and Astronergy (€0.087/Wp).

P-type: Prices inched up to €0.078/Wp, a 1% rise, reflecting stable but cautious demand for increasingly obsolete modules.

Bifacial modules:

N-type: Prices climbed to €0.105/Wp, a significant 12% increase, driven by sustained demand for premium brands and supply constraints. JA Solar, Jinko, Trina, and Canadian Solar dominated transactions, pushing averages higher.

P-type: Insufficient sample size to establish trends.

Full black modules: Prices increased to €0.096/Wp, up 3%, as limited stock met steady demand for aesthetic installations. Despite the uptick, attractive deals remain available on sun.store, particularly for buyers open to high-quality alternatives from lesser-known brands.The supply squeeze, partly tied to China’s recent policy shift from feed-in tariffs to market-oriented pricing (announced February 2025), has redirected production to domestic markets, creating a temporary shortfall in European module deliveries. This window of scarcity is driving urgency among installers and EPCs, particularly for commercial and industrial (C&I) projects.

sun.store

Inverter pricing: Soft demand keeps prices low

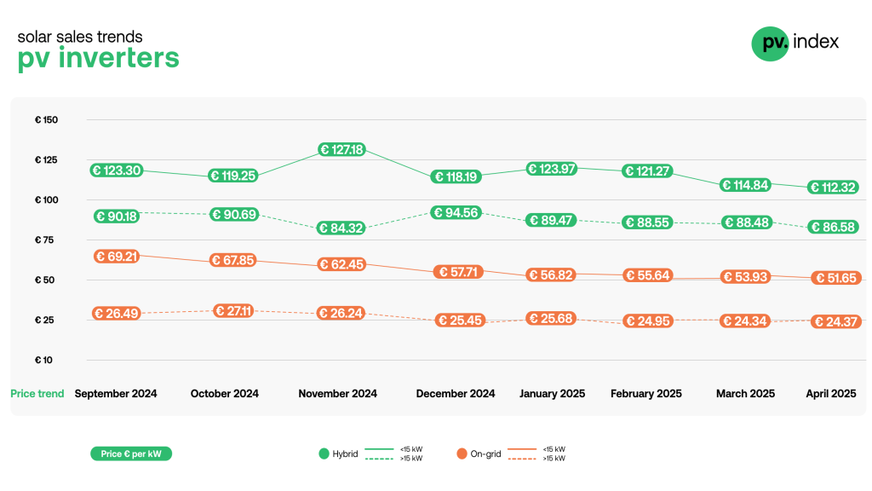

Inverter prices continued to ease in April, reflecting weaker demand in residential and small C&I segments and sufficient stock levels:

Hybrid Inverters:

<15kW: Prices fell to €112.32/kW, a 2% drop, as residential demand remained soft and suppliers competed to move inventory.

>15kW: Prices dipped to €86.58/kW, also down 2%, signaling a slowdown in larger hybrid system orders.

On-grid Inverters:

<15kW: Prices decreased to €51.65/kW, a 3% reduction, driven by ample supply and subdued residential uptake.

>15kW: Prices held steady at €24.37/kW (0% change), suggesting a pause in the downward trend for large-scale systems. Unlike modules, inverter stocks show no significant shortages, likely due to sustained production and weaker European demand compared to China’s installation surge to meet final feed-in tariff deadlines.

sun.store

Brand preferences

Jinko and Huawei maintain dominance

April’s data reinforced strong brand loyalty:

Modules: Jinko Solar retained its top spot, favored for reliability and availability across monofacial and bifacial lines, with JA Solar, Trina, and Canadian Solar also gaining traction. Lesser-known brands are seeing increased interest as premium stock dwindles.

Inverters:

<15kW: Huawei continued to lead, excelling in residential and small C&I markets.

>15kW: Huawei solidified its dominance in larger installations.These preferences highlight a focus on proven performance amid supply constraints.

Outlook for the coming months

With a PMI of 70 and module supply under pressure, the European solar market faces a critical juncture. Price increases for N-type and bifacial modules signal ongoing stock challenges, likely to persist as China prioritises domestic installations. Inverters, however, remain a buyer’s market, with soft demand keeping prices attractive.

US posits tariffs of over 3,500% on solar modules

Buyers can still find compelling deals - especially on full black modules or older stock via sun.store - but these windows are closing fast. As summer approaches, the market’s ability to navigate supply shortages while sustaining confidence will shape Q3’s trajectory.

About – pv.index & The PV Purchasing Managers' Index (PV PMI)

pv.index tracks monthly trading prices for solar components, based on data from sun.store, Europe’s largest online PV trading platform with over 8.9 GW of components available. Prices are weighted by transaction power to provide a reliable market estimate.

The PV PMI gauges demand sentiment in the PV industry, with scores above 50 indicating expansion. It’s calculated from a sample of 630+ sun.store buyers, offering a snapshot of purchasing intentions across Europe.The PV PMI was calculated as: PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0), where: P1 = percentage of answers reporting an improvement, P2 = percentage of answers reporting no change, P3 = percentage of answers reporting a deterioration. Survey is based on a sample of 950+ sun.store buyers. (hcn)