German company Ecoligo, provider of a solar-as-a-service solution for businesses in emerging markets, announces that a further EUR five million has been invested in solar projects via crowdinvestments over the last six months. As a result, ecoligo has doubled its financing volume in a short period of time and has reached the EUR 10 million mark. For the Berlin-based company, the successful growth course of recent years is thus continuing.

2,250 private crowdinvestors realized 8,2 MW solar capacity

Crowdinvestors create in community what the individual is not able to do: Over 2,250 private investors have financed and realized over 8.2 MW of installed solar capacity to date, enabling 37 companies in emerging markets to access clean energy at low prices, enabling their companies to grow sustainably and strengthening the local economy. Over the life of the project, this will save around 126,000 tons of CO2 - 5.5 million trees (beech / maple / birch) would have to live 20 years to compensate the same amount of CO2.*

Did you miss that? NextEnergy Capital`s solar fund expands in Portugal

Demand for "green" investment opportunities has risen sharply in recent years. This is due on the one hand to advancing climate change, which is also playing an increasing role for investors, and on the other hand to the search for alternative investment options in the current low-interest phase. However, those looking for a simple entry point away from equity index funds of companies with a sustainable approach still have a hard time, as many options seem too opaque or risky.

Support sustainable economic development in emerging markets

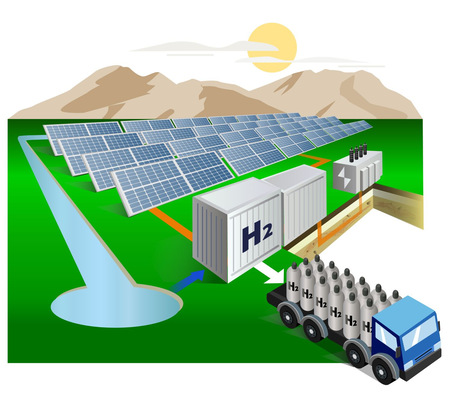

Ecoligo develops solar projects and finances them via crowdinvestments through the Ecoligo.investments platform, giving companies from emerging markets easy and flexible access to renewable energy without entry costs. A financial investment in solar plants in emerging countries not only offers fixed and attractive returns for private investors, their investment also generates a direct CO2 reduction and supports sustainable economic development in these countries. In this way, Ecoligo, together with the crowdinvestors, effectively advances the global energy transition.

Interest rates between five and seven percent

Interest rates between five and seven percent are particularly attractive compared to traditional investment opportunities. Over EUR 645,000 has been distributed to crowdinvestors in the four annual payout rounds to date. At the end of January 2021, just under EUR 130,000 was added.

Did you miss that? Corporate funding in solar increased 24% in 2020

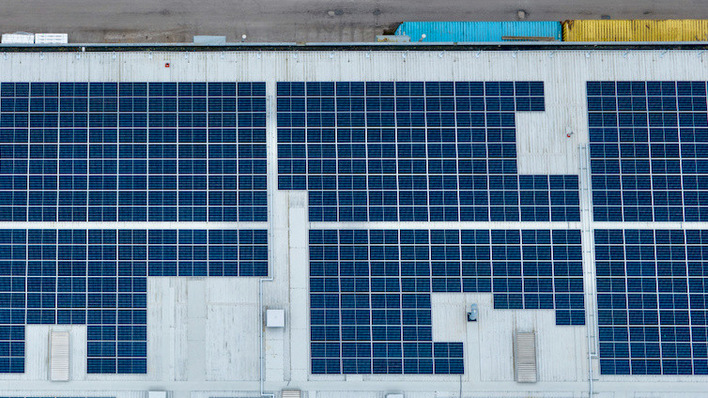

The successful growth course of the last few years proves Ecoligo right: In addition to the EUR 10 million financing mark, Ecoligo also succeeded in entering the Vietnamese market in 2020 and in acquiring RWE's solar energy division for rooftop systems in Thailand. The Berlin-based company, which has other headquarters in Africa, Latin America and Asia, is thus also further expanding its presence in Southeast Asia, where strong economic growth and a sunny climate provide perfect conditions for the introduction of affordable solar energy solutions.

Many solar projects successfully implemented

"We are incredibly excited about the many solar projects we were able to successfully implement in 2020. In particular, the crowdinvesting participation over the turn of the year has been tremendous and has allowed us to reach our EUR 10 million funding milestone faster than expected," said Martin Baart, CEO of Ecoligo.

"However, the focus clearly remains on the need for a sustainable economy: despite a strong economic downturn for most of 2020, global emissions have only fallen by seven percent. To combat the climate crisis, we need a global energy transition to renewables - and much faster than the current trajectory. Every individual can join the fight against climate change through our projects and even profit in the process." (hcn)