Cornwall Insight considers the potential scenarios for UK carbon prices as the country transitions to the new UK ETS, noting the role of market tools, policy and recent pricing trends in determining these costs.

Laura Woolsey, Analyst at Cornwall Insight, has released the following statement:

UK carbon prices to be governed by market tools

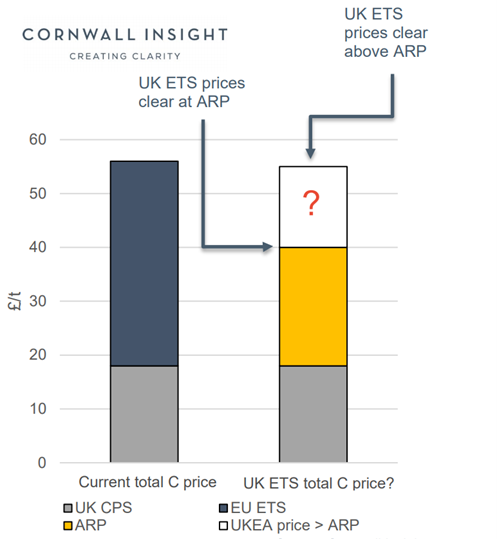

To protect market prices from major disturbances and smooth the transition to the new system, UK carbon prices will be governed by several market tools. Most notably, an Auction Reserve Price (ARP) of £22/t will be introduced to minimise the risk of a significant fall in allowance prices in this transition, establishing a minimum price for which allowances can be sold at auctions. The Carbon Price Support (UK CPS), set at £18/t, will also contribute to the total UK carbon price and be paid for by relevant emitters.

Together, these provide some certainty to the market in setting a minimum overall price for total UK carbon at £40/t. However, further market drivers could push allowance costs higher, creating uncertainty for the total price.

Volatile prices in 2020

The best proxy market to understand trends is the EU ETS, where prices have been notably volatile over the last year. Generally, allowance prices have seen strong upward growth since November 2020, reaching the latest record of €47.49/t on 26 April. The market has been supported by strong commodity price growth and higher demand towards the end of annual compliance deadlines. However, the major driver of this rapid rise has been expectations of increased EU climate ambition and fewer allowances to align with net zero targets.

The UK has initially set its emissions cap 5% lower than the previous cap it had under the EU ETS, which logically could push prices higher. However, the Climate Change Committee (CCC) note that real emissions for 2021 are likely to be significantly lower than this cap which could help balance the price.

Tools for capping carbon prices

A tighter, net zero aligned emissions cap is therefore likely to increase the cost of carbon over time. This price increase could be balanced to some extent by the planned phase-out of the CPS. However, the recent Budget announcement on extending the CPS through to April 2023 gave little in the way of a longer-term transition plan. Without this plan, the tighter caps points towards price rises.

The government also has tools in place to “cap” carbon prices as well as creating floors. These tools include the Market Stability Mechanism and Cost Containment Mechanism (CCM) to reduce volatility in the market.

Possible link to international pricing schemes

The government is planning to use market tools for a good reason. These tools have shown a beneficial impact on prices within the EU ETS. However, likely, the UK ETS will naturally face higher levels of volatility in its early years as the system adjusts to a smaller and, therefore, potentially less stable market.

Noting this, the UK government has outlined linking with other schemes internationally. This could support liquidity and trading, especially if an EU ETS link is established, as many UK businesses have recently called for.

See also: UK: Strong solar growth in the first quarter of 2021

Ahead of auction kick-off on the 19 May, it is clear that price uncertainties remain. However, indicators across the EU ETS market, government tools and actual emissions levels do exist to narrow down the key drivers and create a range of potential price scenarios. It is also clear that UK policy will play a major role in shaping this market as it becomes a key tool in meeting the net zero target. (mfo)