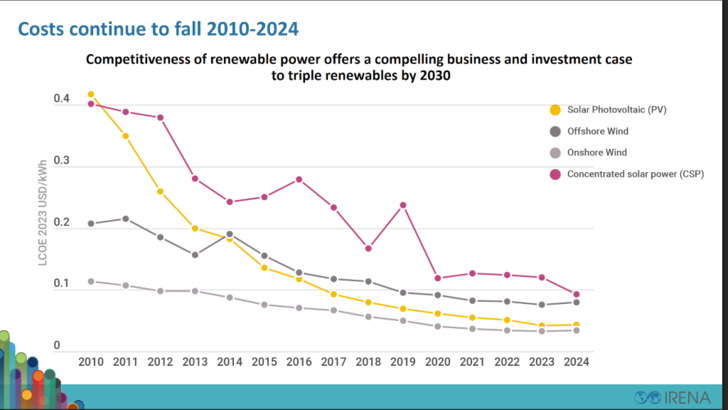

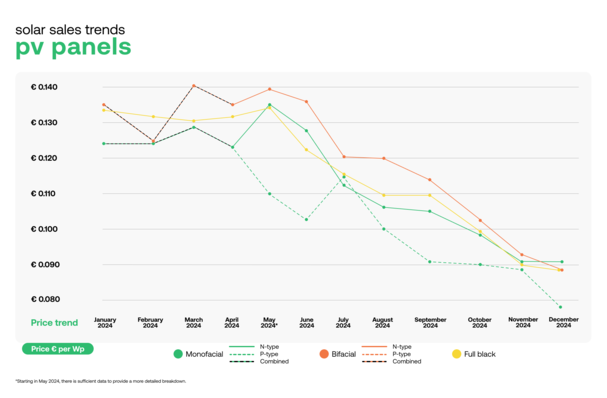

Renewables retained their cost advantage over fossil fuels in 2024, according to IRENA’s latest cost report. This sustained lead reflects continuous technological progress, greater supply chain efficiency and the compounding benefits of scale.

In 2024, utility-scale solar photovoltaics (PV) delivered an average cost that was 41 percent lower than the most affordable fossil fuel alternatives. Onshore wind projects achieved even greater savings, with costs 53 percent below those of fossil fuels, making them the most cost-effective option for new electricity generation at USD 0.034 per kilowatt-hour. Solar PV followed closely at USD 0.043 per kilowatt-hour, reinforcing the competitiveness of renewables in today’s power markets.

The addition of 582 GW of renewable capacity in 2024 helped avoid fossil fuel costs of around USD 57 billion. Notably, 91 percent of newly commissioned renewable projects were more cost-effective than any fossil-based alternative. Beyond direct cost advantages, renewables enhance energy security and reduce reliance on volatile global fuel markets. According to IRENA, the business case for renewables is now stronger than ever.

Cost trends and regional disparities

While long-term cost declines are expected to continue, near-term risks remain. Trade tariffs, raw material constraints and changes in manufacturing, particularly in China, may temporarily increase project costs.

Renewables boom highlights growing regional divide

In Europe and North America, structural challenges such as lengthy permitting, limited grid infrastructure and higher balance-of-system costs are keeping prices elevated. In contrast, markets in Asia, Africa and South America, which have high learning rates and strong solar and wind potential, may experience more pronounced cost declines.

Financing and integration pressures

The report underscores the central role of financing in scaling up renewables. Power purchase agreements, predictable revenue models and stable regulatory frameworks are key to unlocking affordable capital. However, policy inconsistency and opaque procurement remain major hurdles in many regions.

Integration costs are also emerging as a significant constraint. Projects are experiencing rising delays due to grid connection bottlenecks, slow permitting and limited availability of local components. These challenges are particularly acute in G20 countries and fast-growing emerging markets, where grid expansion is struggling to keep pace with the rapid growth in renewable generation.

IEA – solar PV draws more investment than any other energy tech

Financing costs remain a decisive factor in project viability. IRENA highlights stark regional disparities in capital costs. While the levelised cost of electricity for onshore wind averaged around USD 0.052 per kilowatt-hour in both Europe and Africa, project structures varied widely. European projects were driven by capital expenditure, whereas African projects faced much higher financing costs. The assumed cost of capital ranged from 3.8 percent in Europe to 12 percent in Africa, underlining the impact of differing risk perceptions.

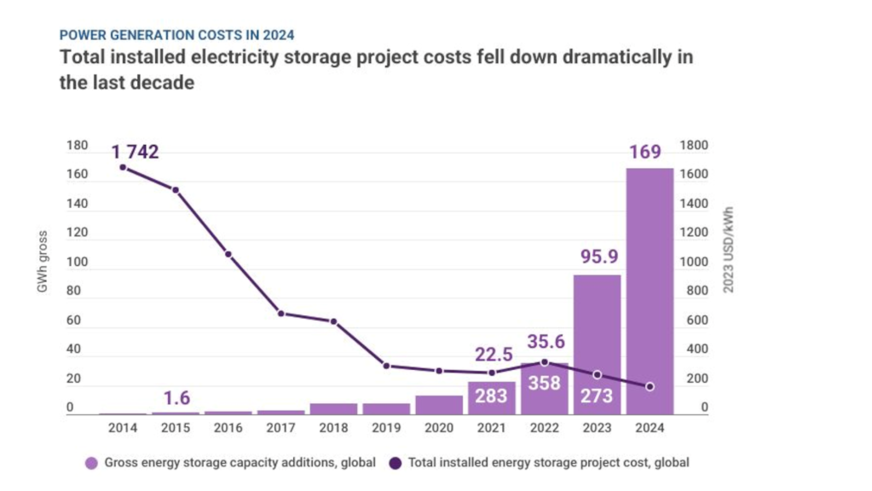

Beyond generation: storage and digitalisation

Technological innovation is advancing beyond electricity generation. Since 2010, battery energy storage system costs have fallen by 93 percent, reaching USD 192 per kilowatt-hour for utility-scale systems in 2024. This decline is attributed to increased manufacturing scale, improved materials and more efficient production processes.

IRENA

Hybrid systems that combine solar, wind and storage are becoming more widespread, supported by digital tools and AI-based asset optimisation. These technologies enhance system flexibility and grid responsiveness, but further investment is needed in digital infrastructure and grid upgrades, particularly in emerging markets.

New EU platform urges tenfold battery storage growth

At the launch of the report, UN Secretary-General António Guterres said: “Clean energy is smart economics and the world is following the money. Renewables are rising, the fossil fuel age is crumbling, but leaders must unblock barriers, build confidence and unleash finance and investment. Renewables are lighting the way to a world of affordable, abundant and secure power for all.” (hcn)