The IHS analysts are predicting a strong market for solar panels for this year. After difficult years and the initial crisis caused by surplus production, the young sector is now experiencing the full impact of rising demand for solar panels: All producers are expecting to grow. As was predicted years ago, China and the US are turning into the most important markets.

Globally this year, the PV sector has grown by about a third. Business is driven most by solar parks and large-scale commercial rooftop installations.

Overall, circa 59 gigawatts of PV capacity have been installed. “The strong demand will remain strong,” the experts of the IHS state in their prognosis for the first two quarters of 2016. “However, growth will slow down to roughly 12 percent.” They are expecting about 65.5 gigawatts in capacity additions.

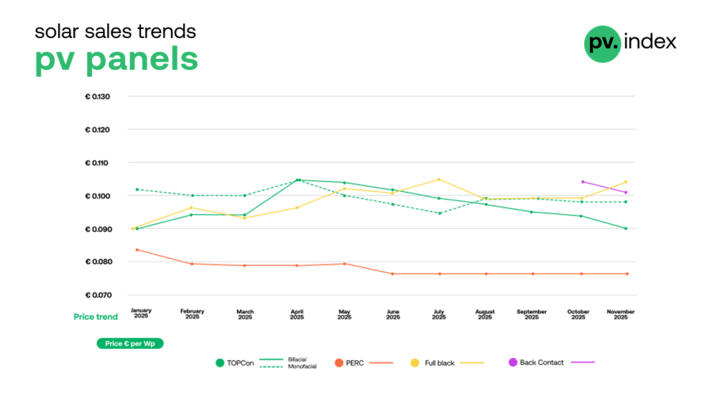

In the US, the strong demand and punitive import duties are balancing out the global trend of prices falling further. Polycrystalline solar panels from India or other regions of the world are already selling for less than 48 US cents. Europe also has import duties on Chinese products, which stand in the way of open competition.

Analysts are expecting the price per panel to only fall a little bit until the summer of 2016. On the other hand, the large (tier 1) producers of solar cells and panels will expand their production in order to meet the rising demand. “Because of the current scarcity, the price for polycrystalline silicon wafers could even rise for a few months,” Edurne Zoco, senior analyst at IHS, says. “Even though prices for polysilicon are declining.”

The kilogram is currently being traded at 12 to 15 US dollars. That is almost a third compared to 2009 prices. And the downward trend continues. But it takes a little time for new wafer and cell production capacity to be generated, and thus have an influence on panel prices. Cells constitute about 80 percent of the cost factors for panels.

Great demand for cells and panels in Europe

German producers of solar panels are also being made aware of how dynamic the trade in cells and panels can be. Heckert Solar is currently expanding their production facility in Chemnitz by 60 megawatts to reach 300 megawatts. Demand from the German-speaking markets of central Europe is quite strong, and there are a number of projects in other European countries.

Growth this year should reach 20 to 25 percent – a great result. Beside the strong demand from the domestic markets, Poland, France and the Low Countries are becoming increasingly important. Heckert is in close collaboration with local distributors, but also with Europe-wide wholesalers such as BayWa or Sonepar.

By the end of this year, their first production line is to be converted to be capable of handling cells with four busbars, as opposed to three previously. Even five will be possible, soon – resulting in higher-performing cells of up to 275 watts.

Overall, Heckert has produced and distributed about 120 megawatts of solar panels in 2015. This year, they could reach 150 or even 160 megawatts. “We already have orders to last us for much of this year,” Michael Bönisch confirms. He is Heckert’s head of sales.

No summer slump in 2015 in the PV sector in Europe

In contrast to previous years, there had been no summer slump in 2015, even November saw hardly any dip in demand. That demonstrates that the PV sector in Europe is now beginning to act like a free market, increasingly independent of political intervention.

Detlef Neuhaus, chief executive of Solarwatt in Dresden, confirms this: “For the last nine months running, we have not been able to keep up with demand.”

Solarwatt distributed about 75 megawatts of panels this year, 35 percent of those were glass-glass panels. “I am sure we could have sold 110 megawatts, but we have to ramp up production first.” Because of the market collapse, Solarwatt had to slow down production in 2014, and when the surge in demand came in early 2015, they were not able to start up their production line fast enough.

Sourcing solar cells in sufficient quantities also takes time. Detlef Neuhaus promises: “This year we will be completely up and running.” In that case, Solarwatt could be able to supply between 120 and 130 megawatts in capacity.

Production is in high gear

At Solarworld in Freiberg and Arnstadt, the production line is also running full tilt. Large-scale orders from overseas and very good domestic sales figures mean that machines are running at capacity.

In order to take as much of the value chain as possible into their own hands, Solarworld restarted the decommissioned furnaces for monocrystalline ingots. When the plant was still with Bosch, ingot production had been phased out because of lack of demand. Now, Solarworld even had to install additional ovens to be able to produce the raw material for monocrystalline wafers.

China is a closed market for German solar panels

German producers understand that the crisis is coming to an end, and other European countries are following.

One important growth market has been alluding German suppliers, however: China is effectively a closed market where German solar panels have no leg to stand on. It is the large Chinese producers who satisfy the local demand with solar panels from Chinese factories.

However, it is expected that – generally and on all continents – support for the PV sector through feed-in tariffs will soon be scaled back even further. Other markets will also increasingly start to work according to economic rules.

But that also means that fewer large or even enormous greenfield generators will be built. Germany is already beyond this point, and from March 2016, the UK market could also begin to collapse.

Restructuring the UK market for self-consumption

The UK’s funding model was changed from being generally more supportive of large generator capacities to promoting rooftop solar and self-consumption. This means that the United Kingdom will within a few months be turned into a self-consumption market, just as is currently happening in Austria and Germany – and soon also in Switzerland.

However – and that was also demonstrated by the German market – this transformation will take some time; up to a year or a year and a half. The UK’s advantage: Products and business models have already been developed in the German market and can now easily be applied and sold in Britain.

But this will have little positive impact on solar panels, but rather on producers of small inverters and storage units.

The US will phase out or severely reduce ITCs this year. From 2017, the North American market is expected to slow down significantly. IHS estimates a reduction of capacity additions to a mere eight gigawatts: “Even 11 percent growth rates in the rest of the world could not make up for such a decline.”

Because competition remains very strong, the average retail price for solar panels should keep falling in the second half of 2016. “In 2017, global demand will weaken slightly, because the number of new large-scale projects in the US and China will come down,” Edurne Zoco of IHS states. The pressure to generate profits for the panel producers will also remain very high, at least in part because new solar panels are coming on the market which achieve higher energy densities using innovative technologies.

What role do customs duties play?

Because solar cells play an important role in the value chain, the focus of innovation will remain on them. This means, however, that only producers that can maintain an army of engineers and cleanroom laboratories will have a chance of making it. Meanwhile, the battle over punitive customs duties on solar panels and cells from China and Taiwan rages on. Brussels has to decide whether to uphold these sanctions. Advocates from the Prosun initiative and opponents from the Solar Alliance for Europe (Safe) are fighting it out in public and behind closed doors.

Recently, over one hundred Solarworld technicians came forward to defend customs duties. Holger Krawinkel, Safe spokesman, reacts: “Solar panels could be as much as 25 percent less expensive today. That could encourage significantly greater capacity additions.”

It is more than a question of price

As things stand, polycrystalline panels are being traded on the world market for as little as 38 US cents per watt. It is doubtful whether such a price can actually cover production costs. And even 40 or 45 cents per watt probably will not provide much of a stimulus to the German market.

German investors and technicians are increasingly making a conscious choice in favour of German products, because regardless of price, considerations such as availability and reliability are also important within the logistics of a building site. Especially in commercial rooftop installations, where solar technicians might need to make allowances for ongoing production, logistics is a key factor.

When pricing a solar installation, the panels only make up 40 to 50 percent of the total cost of the project. Add in storage or heating, and the share of the solar panels in the overall price shrinks even further.

Possibly better outlook for greenfield sites

In greenfield solar parks, the struggle over prices is much more fierce. Because storage or supplementary systems do not yet play an important role here, the price of panels still dominates the overall price of the installation. Tendering processes have resulted in a price of 8.5 euro cents per kilowatt hour. In practice, it will not be easy to actually implement such very frugal tenders.

As far as solar parks are concerned, falling panel prices might indeed have a positive effect on capacity additions. Which is why Trianel, an association of municipal utilities, supports Safe’s demands. “Such trade restrictions are detrimental to the energy sector and the consumers, because they make solar energy more expensive than it needs to be,” Christoph Schöfer of Trianel in Aachen states. Solar parks are power plants that feed electricity into the grid, but for most solar technicians, the future is in self-consumption. These two are based on very different business models. (HS/IR)