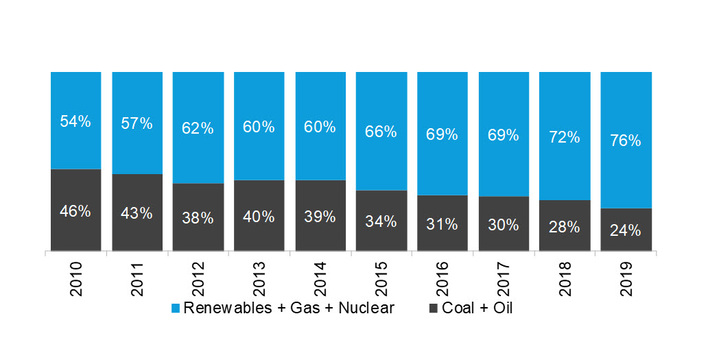

Solar accounted for 40% of all new electric generating capacity in the U.S. in 2019, its highest share ever and more than any other source of electricity, with 13.3 gigawatts (GW) installed.

Despite policy challenges and a second year of the Section 201 tariffs, the U.S. solar market grew by 23% from 2018, according to the U.S. Solar Market Insight 2019 Year-in-Review report, released today by the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

“Even as tariffs have slowed our growth, we’ve always said that the solar industry is resilient, and this report demonstrates that,” said Abigail Ross Hopper, president and CEO of SEIA. “We know anecdotally that the COVID-19 pandemic is affecting delivery schedules and our ability to meet project completion deadlines based partly on new labor shortages. This once again is testing our industry’s resilience, but we believe, over the long run, we are well positioned to outcompete incumbent generators in the Solar+ Decade and to continue growing our market share.”

Full impacts of the coronavirus outbreak on the solar industry still developing

SEIA and Wood Mackenzie are closely monitoring changes to the industry as a result of the COVID-19 pandemic. As of the release of this publication, the full impacts of the coronavirus outbreak on the solar industry are still developing.

Did you miss that? Global solar market negatively affected by coronavirus

Given the dynamic nature of the outbreak, it is too early to incorporate any changes into our outlooks with enough certainty. Wood Mackenzie’s solar team is tracking industry changes closely as they relate to solar equipment supply chains, component pricing and project development timelines, and our organizations will issue follow-up reports on the impacts of the pandemic.

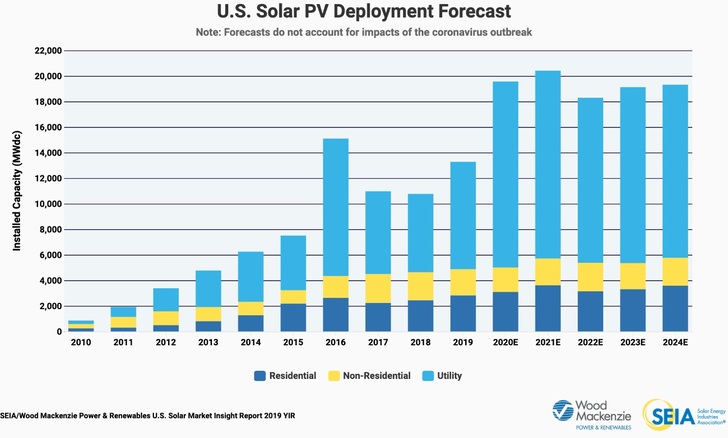

Forecasted growth of 47% in 2020

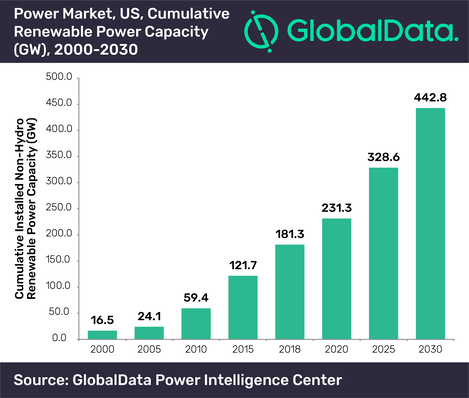

According to the report, total installed PV capacity in the U.S. was projected to rise by 47% in 2020, with nearly 20 GW of new installations expected by the end of the year. Each of the next two years were expected to be the largest on record for the U.S. solar industry.

The residential solar sector saw record-setting installation totals with more than 2.8 GW installed, led by a record year in California and continued growth in emerging markets. The segment saw annual growth of 15% while achieving its highest installation volumes in history.

Florida with booming rooftop solar market

But emerging markets also deserve credit for this year’s record-breaking installations as Florida installed the second most rooftop solar in the country after California.

“With much of the residential solar market to-date driven by California and Northeast states, Florida is a window into the future of the national residential solar market given its resemblance to the vast swath of markets with no state-wide incentive programs or the high electricity prices that make rooftop solar so attractive,” said Austin Perea, Senior Analyst with Wood Mackenzie.

Contracted utility-scale PV pipeline of 48.1 GW

Meanwhile, the utility-scale market added 8.4 GW of new capacity in 2019, more than half of which came online in the fourth quarter. The 4.4 GW of utility PV installed in the fourth quarter makes it the second-largest quarter in history for the market. A total of 30.4 GW of new utility PV projects were announced in 2019, bringing the contracted pipeline to a record high of 48.1 GW.

Community solar market diversifying

In 2019, non-residential PV saw an annual decline of 7%, due largely to policy reforms and interconnection delays in key states like California and Massachusetts. A shrinking pipeline of community solar projects in Minnesota also contributed to deployment declines, while community solar markets in New York, Maryland, Illinois and New Jersey are expected to grow going forward.

The emergence of Texas and Florida as top solar states, along with strong year in established markets like Arizona, Georgia and North Carolina, helped drive solid growth in 2019 across all segments.

Over the next five years, total installed U.S. PV capacity was expected to more than double, with annual installations projected to reach 20.4 GW in 2021 prior to the expiration of the federal solar Investment Tax Credit for residential systems and a drop to 10% for commercial and utility-scale customers. (HCN)