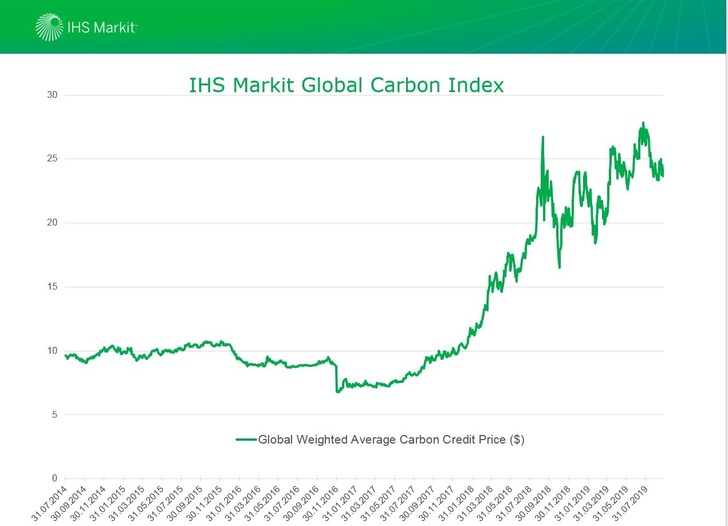

According to the IHS Markit Global Carbon Index, the global weighted average price of carbon credits is $23.65. Since the beginning of 2018, the total return potentially gained by investors in global carbon is 132 percent, index data show.

The design, construction and administration of the IHS Markit Global Carbon Index is a result of extensive collaboration among the firm’s Indices, Environmental and Energy businesses, including OPIS, the company’s energy price reporting arm, which offers data and pricing services to help businesses manage costs and risks associated with national and regional environmental compliance programs.

New benchmark for corporations, investors and financial services firms

“The IHS Markit Global Carbon Index creates a valuable new benchmark for corporations, investors and financial services firms, all of which have to navigate the emerging but increasingly important markets for carbon credits,” said Sophia Dancygier, managing director and head of Indices at IHS Markit. “It also demonstrates our ability to apply our expertise in data, energy and other major industries and capital markets to develop unique products to address the most pressing and complex information demands within business today.”

The Global Carbon index tracks the performance of the largest, most liquid and most accessible tradable carbon markets, namely the European Union Emission Trading System (EU ETS), the California Cap-and-Trade Program, and the Regional Greenhouse Gas Initiative (RGGI). The index is calculated using OPIS data and carbon credit futures pricing in those markets.

57 jurisdictions with carbon price mechanisms

Putting a price on carbon dioxide emissions through cap and trade programs and other market-based mechanisms is a primary strategy for reducing carbon emissions. Worldwide, 57 jurisdictions have carbon pricing mechanisms, up 34% since 2017.

The IHS Markit Global Carbon Index was developed in consultation with Climate Finance Partners, a specialist in climate finance.

“The IHS Markit Global Carbon index creates an important benchmark which helps financial institutions to better assess and price climate-related financial risks,” said Eron Bloomgarden, co-founder of Climate Finance Partners. “We see growing investor interest in carbon credits as an asset class.”

IHS Markit administers more than 14,000 benchmark, economic and tradable indices across assets. More than $130 billion in assets under management are held by exchange-traded funds referencing IHS Markit indices. (HCN)