According to a recent study by the Bonn market research institute EuPD Research, solar generators are increasingly sold with energy storage. More than half of the new plants installed in 2014 and 2105 are equipped with solar batteries. The proportion of such combined systems is expected to grow significantly in 2016. Of all customers who are currently planning on installing a photovoltaic system, only 20 percent are not interested in separate battery storage. In the past, the most common reservations towards storage systems were lack of economic efficiency and high costs.

A reluctant start for business in the retrofit segment

The retrofit segment covers existing installations that are retrofitted with energy storage. Only around 10 percent of customers have a battery system installed without a photovoltaic system. In consequence, the residential storage market continues to depend on the economic situation in photovoltaics. In contrast to commercial battery storage that is often installed independently from photovoltaic systems, as in addition to wind farms or block heat and power plants. In this market segment, competition has already assumed international dimensions.

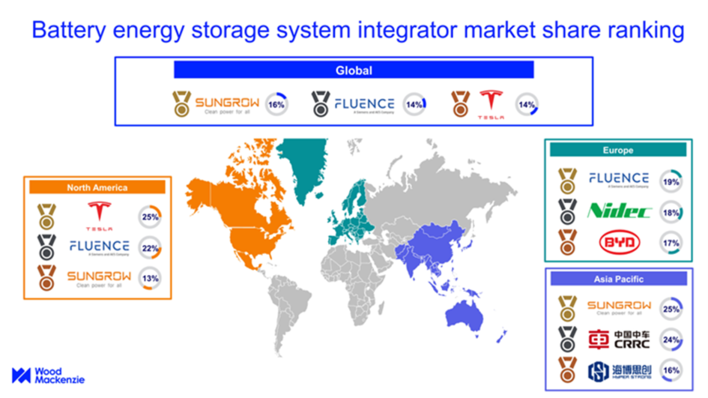

United States, South Korea and Japan determine utility storage market

The very large segment of commercial utility storage is determined by North American and and Asian markets. In the United States, South Korea and Japan, more than 100 megawatts of storage capacity was installed in the commercial segment in the past year. Together, these three countries account for almost 60 percent of the world market for stationary energy storage.

Prices for lithium-ion batteries will continue to fall

According to analysts from IHS, the system prices for lithium-ion batteries will continue to fall in the next few months and years, and significantly so. Since 2012 until the end of 2015, the system prices have already fallen by 53 percent worldwide. By 2019, analysts at IHS predict those prices will be halved again.

In addition, the cost of power electronics (battery management systems, inverters and battery inverters) continue to fall which means lower costs will open new markets. Especially larger storage systems that do not offer high performance will be cheaper. High performance energy storage requires greater expense, so prices should not drop as fast as for larger capacity storage systems in this segment. (HS-IR)